Ireland & The Bailout and Prospects for Recovery.

Bond markets have already factored in an Irish default.

Given it is just days away from the election and a new government, most likely to be led by Fine Gael, many are probably wondering what exactly is the current state of Ireland and what are the prospects for recovery. In short, things are bad and a recovery is very unlikely. There are also wider and bigger global issues and we are unprepared and should be doing something about it now.

The only hope is that we have is that there is a public awakening to try and understand what has happened, where we are and the future we are hurtling towards. Only then, is there any possibility of some kind of social revolution to enable us to have any chance of coping with the challenges and by our actions, hopefully we may even trigger an European wide social transformation. But frankly the prospects of this positive development happening are zilch.

When the global credit boom came to a halt and hit Ireland on that fateful day in Sept 2008, Brian Lenihan, at the behest of the bankers made a fatal mistake with the bank guarantee that ensured no (large) debtor would be left behind. It might have seemed like a good idea at the time, but it would only have worked if the global economy bounced back and it was clear it was not going to unless like many mainstream economists who propagate the dominant capitalist ideology of our time, they assumed it was just going to be another small recession in the usual business cycle. But anyone who had been following events without their ideological blinkers on, would have realized this was going to be of seismic proportions.

The way this bit of history is presented is that it came like a shot out of the blue. However it is now known Merril Lynch and others had advised the government in the days to months before. For example Ref[1] shows they were already thinking about the legal implications of bank nationalisations 5 months before in Apr 2010. And in Ref [2], in a presentation to the Finance Dept this is spelt out: Open-ended State guarantees exposing the Exchequer to the significant fiscal risk are not regarded as part of the toolkit for successful crisis management and resolution This quote actually comes from another Dept presentation as far back as Feb 2008, see Ref [3] where it is abundantly clear they could see a banking crisis was looming and they were working out all the different scenarios and had already come to the conclusion they would need to have a draft bill ready to enable it to happen. And to this day, dozens of sections of these reports remain censored. And why would that be? Because it would show they had plenty of warning signals. This is one of the key arguments that Fianna Fail use and it is: 'we're sorry but we didn't know'. They did know. People should take note that the importance of who and how history is written because it has already been badly twisted and misrepresented although it is central in the shaping of public opinion and "facts". FF have been very careful to confuse and distort the sequence events with the prime objective of ensuring they don't get any of the blame and to paint themselves out of the picture 5 to 10 years down the road and thereby allow them to recover politically. Regrettably the dominant history is usually written by the regime in power and almost always fits in with their narrative.

To return on topic, since Sept 2008, there were several opportunities to wriggle out of the bank guarantee but instead the FF government and the banking elite got us into deeper problems. As we all know in those past two years, both of these groups have set out to consistently and regularly deceive and play down things to the public. They first pretended the losses were only a few billion, then just tens of billions. They even had a press conference and coverage in the media to persuade us NAMA would turn a profit. Then we had the fake bank stress tests designed to pretend the banks were fine and the "results" confirmed that. We heard that losses for Anglo were only 20 to 30 billion euro, yet they still rise along with those for AIB. And through all this period, the one person who called it right, Prof Morgan Kelly (UCD), said that the bailout would cost €100 bn, the banks would be nationalised and house prices would fall about 70%, has proved to be correct. At the same time, the corporate/capitalist media who de facto are always going to promote the infinite growth ideology, uniformly portrayed the financial crisis as a result of greedy house buyers wanting too much and bidding up the price of property. In fact the reality is quite different and much of the debt is in the investment and commercial sectors and for overseas property particularly in the UK. (See ref [4] ). The point of the media onslaught was to make the public think it was caused by them, so that they would therefore be more willing to pay for the bailout through higher taxes and the shredding and privatisations of ALL public services eventually. A bit later in the crisis, we had a further escalation in the new Class War when the media pitted the public sector against the private sector; the point being to divide all workers to ensure there would be no united front of opposition. Indeed the plan has worked to perfection so far.

But things have moved on since then. In late 2010 there were rumours for a while that just after the 2008 crisis, Anglo Irish Bank tried to recuperate its losses by entering the financial derivatives market where the clueless captains of finance blew another 10 to 20 billion and this may have been linked in some way with the triggering of the European Central Bank (ECB) coming into the picture which all ended with the EU/IMF bailout. However it does seem that the haemorrhaging of deposits from the Irish banks from Sept 2010 onwards meant they had to borrow off the ECB to replace them and it was after we racked up totals of 130 billion in the short space of a few months that they called a halt. The point of about the derivatives mentioned above is that if some key players knew about this -assuming it happened, that alone would make them lose all confidence in the Irish system and trigger them to withdraw money. And a third reason is that bank bonds had matured and had to be paid off and since the short term credit market doesn't really exist anymore to roll these over, they had to borrow of the ECB instead.

In Sept 2010, the legal window for getting out of the Lenihan Bank Guarantee closed and our fate was truly sealed then. According to Kelly (ref [5]), Ireland had the legal option of terminating the bank guarantee on the grounds that three of the guaranteed banks had withheld material information about their solvency, in direct breach of the 1971 Central Bank Act. There is still a small minority of opinion that is awake and says we should burn the bond holders. Alas, it is sad to say the Irish govt has already paid them off; 55 billion by Sept 2010. We borrowed from the ECB/IMF (above) to do that. So we won't even get the satisfaction of doing that. We will have to burn someone else instead.

It was the ECB/IMF deal that really alerted the public that all was not well and it isn't. What people don't realize is some of the other promises FF added in as a sweetener to the deal. There is talk that they have signed away in some kind of secret agreement, our national assets but it is unclear what they are, considering we gave away Corrib Gas worth perhaps €8+ billion and Bertie Ahern is already involved with private investors to sell off Coilte who own 7% of Ireland. Republicans where are you on this one?

Back on the banking front, things have entered the surreal and private and sovereign debt has become totally blurred and confused because the banks have been issuing government guaranteed bonds to themselves which they then use to go off to the ECB to cash in. Anglo have been hiding these by referring to them as Special Master Repurchase Agreement. More details in ref [6]. What is important is through this latest ponzi scheme another mountain of debt in addition to the existing debt is ballooning but the government have placed this off the books. It the type of stuff Enron did. So our debt is not just the 85 billion we owe to the ECB/IMF, its a lot more. Constantin Gurdgiev reports the bond markets have already factored in our default. Meanwhile the media and the government spend all their time focusing on the day to day current expenditure and the gap between that and taxes and while there is a gap it is dwarfed by the bank debt. But at least the diversion once again is a useful tool, because public opinion is being misled into thinking it is the civil service pay and our fantastic health, education and social services that are the real problem. Certainly not those bankers or developers. And if people would be just more positive, this crisis would be over. The trouble is you actually hear punters repeating this rubbish if just proves its effectiveness.

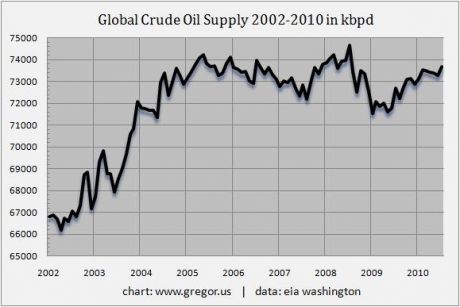

The backdrop to all this is in the end things will come right. If we just focus on the future, say out around 2013 or 2015, all those rosy projections by governments and institutes of all hues, suggest the world economy will begin to grow again and we will begin to recover from this crisis. The assumption is that it just gets better after that even if it is all a little slow. We know based on these scenarios, the chances of Ireland (i.e the taxpayers) of paying off not just this mountain of debt, but a whole mountain range of separate mountains of debt is slim and would take a long time. It is time to break the news. The reality is quite different. There will be no recovery. Therefore the debt will never be repaid. Not here in Ireland, not in Japan, UK, USA, Greece, Spain, Portugal or anywhere else. Some of you will of course be aware of Peak Oil, others might remember George Lee doing a programme on it on RTE in June 2007, ref [7]. Unfortunately some people still think Peak Oil is a theory when it is a historical fact. The International Energy Agency (IEA) has for years presented forecasts at odds with that produced by the geologists of the Peak Oil community most of whom had worked in the oil industry all their life. The IEAs role has been to play it down. A decade ago it was churning out forecasts for future oil production that were pure fantasy but crucially matched what the status quo required. In recent years it has reined these in, each year steadily revising downwards its forecast. Finally in Nov 2010 they conceded defeat and admitted Peak Oil happened in 2006! (Ref [8])

Past and future global oil production and number of cars in Ireland. One depends on the other

So why is oil so important? The answer is quite simple because it powers are entire society from the vast majority of all our transport, 100% of air travel, it powers industrial agriculture through all the fossil fuel burning tractors and other machinery. It subsidises all other forms of energy. When the industrial revolution took off on the back of iron and coal, it got a boost when oil was discovered and began to overtake coal in the early decades of the last century. Since then population and economic growth has been fuelled by this plentiful, energy rich and very flexible easy to handle fuel source. There is nothing quite like it. Think what a can of petrol can do for your car. You just pour it in and it will take your half tonne car at least 10 or 20 miles. In terms of human energy it must correspond to at least 20 people pushing it. Or try do this with uranium and you will need a team of highly trained specialists with radiation protection gear and remote handling mechanisms. The standard reply to the oil question these days is a religious reply and it comes from the church of everlasting progress. Its adherents are everywhere and its creed is simple. We have advanced for the last 200 years and therefore we will continue to do so. They also invoke the word 'technology'. But technology is not the same thing as having easily accessible reserves of hundreds of billions of barrels of oil just waiting to be found. The other half of the answer is that we have alternatives. At this point it is best flicking through a copy of the Hirsch Report, ref [9] which was commissioned by the US Dept of Energy. It basically says we should plan for Peak Oil decades in advance and at a minimum a crash course of preparation even one decade in advance would cause major economic disruptions. Hint, there has been no preparation and now we are past Peak Oil. In short introducing a new technology can take 30 to 40 years especially one as large as your energy infrastructure.

To help clarify the consequences of all this some key points need to be emphasised and logical arguments outlined. First, it is energy in the form of petrol derived from oil that powers your car. Stuffing 50 euro or dollar notes in the petrol tank won't work. Second, if all the oil currently produced is required to run society in all its imperfect forms as it is now, then it follows less oil means it won't operate to the same extent. There are valid arguments about reducing inefficiencies but in all cases the lowest hanging fruit gets picked first. This means when you are forced to increase efficiency, you will get good results initially from getting rid of the big inefficiencies but it will get progressively more difficult each year to get further gains and it will require more effort, capital and ingenuity to achieve further gains. Here's the big clanger. The IEA who are a conservative bunch, estimate once we get off the bumpy plateau of oil production that declines will be somewhere between 4% to 7%. (Discussion at ref [10]). This means to stay static in terms of the needs of the global economy and taking NO account of any future economic growth, that your efficiency gains would have to match this every year. You have a chance of doing it the first year, possibly the second, slim the third. The task is best illustrated with this graph.

In the bubble years 2000 - 2008 in Ireland and elsewhere, growth seemed like it would never end and property prices were going to rise forever. Anyone who challenged this belief was derided. Poor old David McWilliams tried. So too did George Lee. He even had a programme about it all coming crashing down. But he was castigated as been negative unlike those geniuses running our banks and those developers planning white elephants everywhere. Well here's something to consider. The last 200 years of growth based on abundant cheap energy is like the years 2000 to 2008 but bigger and longer. But just like those years when the ability of people to buy and pay for property ran out, because the credit bubble burst so too, this long period of industrial expansion, population expansion and growth is coming to an end because the thing that has enabled it is not around in the same quantities. Much has been actually written on this topic except it isn't too mainstream and the consequences of Peak Oil have thrown up camps who have span from the optimistic of we will be fine to the pessimistic of we won't. There is a lot of ground in between and its actually up to you the reader to do the research yourself and validate your findings and conclusions and do more research of your own to check again. Ref 11 is a good place to start.

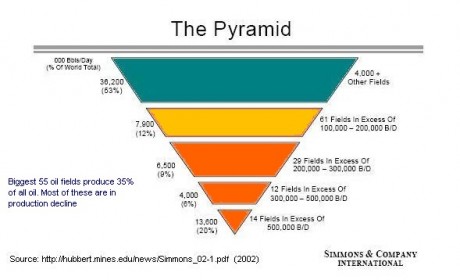

A final piece of the puzzle is to familiarize yourself with Energy Returned on Energy Invested (ERoEI/EROI). What this means is that it takes energy to find energy and deliver it to where you need it and use it. So for example, those pumps sucking oil out of the ground need energy to work and more energy to transport by tanker to a distant oil refinery. Then in the refinery where you basically boil the oil and distil it, pretty large amounts of energy are consumed. You are still not finished because it then has to be trucked to petrol stations all around the country. So how much energy is used then? It turns out to be a difficult area to get a precise figure and there tends to be much debate, but it looks like when oil was first discovered, if you burned the equivalent of 1 barrel you could get 100 barrels. It was so easy to get and find back then. For Middle East oil, it is reckoned to be range from about 1 in 30 to 1 in 20. For oil in the Gulf of Mexico as we know now after the BP disaster last year, its a tricky, expensive and challenging environment and the EROEI is estimated around 1 in 10 or slightly less. For the Tar Sands in Canada, it is estimated to vary from 1 in 3 and downwards. The EROEI is bound to vary from quite a bit so it is best to think in terms of ranges. For ethanol from corn, the most optimistic seems to be 1 to 2. Others suggest it is 1:1. Obviously if you have to burn the equivalent of one barrel of oil to get one barrel of oil, there is no point and the price of the barrel has no bearing, because energy is a physics thing. As stated above shoving tenners or fifty notes at it makes no difference. Thats just paper! The key thing to note is that ERoEI has been falling for years. It makes sense because in the early days of Saudi you just went out, found a giant oil field and stuck the pump down a bit and you were fine. At this stage practically all the giant fields have been found and are in use and depleting. The size of oil fields discovered has been declining too. Discoveries peaked in 1964. By the time you are drilling in the North Sea, Gulf of Mexico or somewhere in the Arctic, you have to build huge expensive platforms not just in terms of money, but in iron, steel and cement. You need an army of workers and incredible behind the scenes supporting industrial base to produce the drilling and processing technology. Of course it is going to be more expensive in terms of energy and money too. That is where we are. A very good argument put forth is that if ERoEI has been falling for years, it doesn't seem to matter because there has been no problem and there seems to be a lot of the lower ERoEI oil around. The graph below really does save a thousands words. We will be fine up to a point then once we starting hitting an overall ERoEI lower than 10, we are in big trouble. This ERoEI graph is central to understanding the role of alternative energy sources. Wind power so far is estimated to have the highest EROEI somewhere around 15. It all depends where the turbine is located, the windier the higher the EROEI. The other alternative technologies like solar are varied but seem to have lower EROEI estimated from 5 to 10. Biomass can be in the negative range and perhaps as high as 2 or 3. Again it strongly depends on soils, latitude, water availability and the like. The techno optimist camp simply says we will replace everything with wind and solar power and we will just switch to electric cars. There are two main features with this argument which are we will keep the cars, the geeks will roll out the wind & solar and everyone else can continue more or less as normal so long as they give the nod to it all. A deeper analysis suggests the required cultural changes will go much deeper and will involve practically everyone.

ERoEI falling = bad news

The techno optimistic arguments dismisses all other global problems like global warming, fisheries collapse, water shortages, widespread pollution, species loss and an enormous population. An examination of what alternative energy might be able to do or provide suggests it might provide enough energy to provide buses but it simply won't scale up to keep us all in electric cars. If you assume a bus carries 40 people it is easy to see that providing the energy for a bus is of the order of 40 times less. A common problem is the sheer quantity of energy that oil provides us is not properly grasped and the scale of the build out you would need to do the same with wind and solar is mind boggling. In short we would probably need a good size of the remaining energy embodiment in the oil in order to build it and it could take decades. This is largely besides the point at this moment because the very structure of our (global) capitalist society in the way all activities are met (and a good chunk is based on the automobile, cheap air travel and such) is highly dependent on cheap abundant energy and is very fragile and sensitive. We have seen that the combination of the 2008 oil price spike and credit crunch has taken a wrecking ball to it and it hasn't recovered yet. It has a large number of weak points and structures. For example much of our food has travelled hundreds, sometimes thousands of miles to reach us. New Zealand apples anyone? Spanish tomatoes? Potatoes from Cyprus? Agriculture itself is dependent on fertilizer which requires vast energy inputs to create. Most people drive to work. Suburbia makes it almost impossible to exist without a car. You can probably think of solutions to mitigate permanent energy declines, but you will soon realize the very economic fabric and that of the physical built environment would have to change too.

We are not at an overall ERoEI of 10 yet but we are approaching it and combining that with declines of 4% to 7% once they begin to set in, then it is not hard to see that all this credit crunch stuff is going to seem like small fry. Lets say people are going to be driving less for one and flying less too. And all that money we spent on new motorways will become an very obvious bad decision. For a lot less we could have widened some roads and put the rest of the billions we spent on rebuilding and expanding our rail network for the rainy days ahead.

Peak Oil is a lot more connected to the credit crisis than generally acknowledged. From circa 2003 to 2008 oil prices steadily rose to a peak of $145 a barrel and it had almost no effect on increases in production. Some would argue the price rise was purely speculative but there has to be a basis for it, so undoubtedly a significant fraction of the increase was because global oil production has been at its maximum, the economy needed more and no more could be had. One of the predictions from the Peak Oil camp is that at Peak, oil prices would ramp up cause a recession where demand and price would fall. As the system recovered again the demand would rise along with oil price until the same thing happened again. This would go on indefinitely but with each cycle, industrial society would be set back further as oil depletion continued.

If you borrow E100 at 5% interest, you are more or less relying on the system to grow to generate the wealth to create that extra 5%. In the case of just 100 you will probably do without something next week to cover it. When society or the economy as a whole borrows billions it can only pay back the sum PLUS the interest if that economy grows. In ancient times, economies grew very slowly and charging interest was frowned upon and quickly led to debt enslavement. In the past century economic growth enabled by cheap abundant energy changed all this. It is not really surprising that in the last decade or so the era of debt fuelled expansion has corresponded to the upside of the global peak of oil production since after all this represents the period when we had the most energy available to grow and optimism about it lasting forever was in vogue just like the peak of the property boom. Exactly at the same time the financial economy went on its mad bender much of it fraudulent. What it did was to clock up massive debts through financial derivatives and other instruments which are at their core a claim on wealth in the future. They represent the taking of profits from the real economy for decades into the future and the unstated underlying assumption was the real economy will being growing in order to pay it all back. To understand this a bit more think about it this way. Who goes to the bank for a loan and says to the bank manager: 'Actually I expect my salary to fall steadily over the next 20 years while I am paying off this mortgage'. I doubt he would give you the loan. No we all go there expecting it to rise and in a few years our mortgage will be in relative terms a smaller percentage of our salary. Imagine if your mortgage initially took 30% of your salary and gradually increased to 80% or 90%. I think you might starve if you continued paying. Thats the situation all the real economies of the world face with the situation where the parasitic financial economy is on their back. The notional "monetary" value of the global financial economy since the 1980s has ballooned way past the notional "monetary" value of the real economy (where stuff is produced) and is now hundreds of times bigger.

In summary then we are all going to default so we should stop paying now, wake up to what is the physical reality in terms of available global energy to keep things going, accept deep changes are required urgently and do away with the present order of things because they will be changing anyhow. We need a social revolution. Some might think perhaps the suggestion is a communist or socialist one and perhaps it is, but it has to be one without a KGB or Central Committee. It has to contain one of the better features of Capitalist which is that it allowed enough room for people to try things out and fail. Not one where rigid dogmas come to the fore. That is the trouble with all ideologies; they have this religious element to them which leads to the 'burn them at the stake' mentality. Capitalism has that too. On a broader scale so far most of our past regimes including the present are a form of severe immaturity at a society level. We need to grow up. We childishly think technology is our saviour and whilst it has advanced a lot, there has been almost no corresponding social advance. The reason is probably because to advance technology just takes a few geeks, but social advances requires everyone to be involved. Similarly a true democracy requires everyone to be active participants not passive drones who fill out a multi-choice ballot paper every 4 years. In other words our worship of technology distracts from our real responsibilities and glosses over our lack of social engagement. Similarly I find challenging and pointing out that the present electoral system does not represent the pinnacle of democracy frequently provokes an angry response, the sort you expect from religious fanatics where their faith is challenged. We all hate change, but change is coming. We are living in exponential times where everything you can think of has been soaring upwards. But all exponentials in real life come to and end and we are at that point now. If you have a 20 year mortgage you just acquired at the height of the bubble, do you really think between now and 2031 Peak Oil isn't going to finish off the financial system. Take a lot at the Peak Oil graph above and look at where things will be. And what about that pension you have? Do you really think it is going to grow at 2% to 3% a year for the next 20, 30 years? And what if those folks crowing about global warming are right and weather patterns shift along with the optimal places to grow food. What then? What effect will it have on you. Will you still be driving to work every day? Will you still have a job? If we all do nothing the richest 1% will maintain their position but they will need to impose a brutal and corrupt Egyptian or Libyan type regime to maintain it. So when you go to the polling booth on Friday, think how the present political order is totally incapable of meeting the challenges ahead and how pathetic and disempowering voting every 4 years is. We need to devise some mechanism to harness the collective intelligence of everyone not discard it.

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου